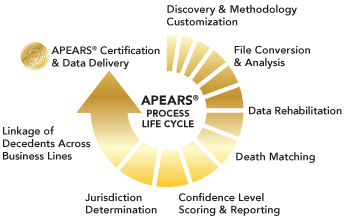

The insurance industry is under unprecedented scrutiny after the high profile John Hancock settlement which left many wondering what they need to do to comply. Cross Country Computer takes the guesswork out of the process with its patented Abandoned Property Escheat Assignment & Reporting System (APEARS®) which satisfies state and audit mandates requiring fuzzy matching to the Social Security Administration’s Death Master File (SSA DMF) to identify those who are deceased. APEARS® has been successfully utilized in support of all major insurance company demutualizations in recent history and with accuracy well in excess of 99%, has the ability to exceed the requirements set forth in all of the publically available Global Resolution Agreements (GRAs) and Regulatory Settlement Agreements (RSAs), as well as all of the state-specific legislation including NY’s Reg-200.

Our 35+ years of data management expertise enables us to cleanse, rehabilitate and successfully match your books and records data to the SSA DMF to identify true decedents, while our increased resolution helps to reduce an insurer’s manual effort by ranking each determination from strongest to weakest. We can take these results a step further by leveraging supplemental deceased sources, performing escheat jurisdiction determination and linking multiple accounts across your different business lines to common individuals using Transfer Agent approved house-holding algorithms.

Quickly and accurately identifying decedents allows holders to meet reporting requirements, speeds the resolution process, and improves the ability to contact beneficiaries in lieu of policy proceeds being transferred to the states.

- Reviews insured, owner and beneficiary records using data in holder's books and records

- Utilizes the state mandated Social Security Administration's Death Master File

- Scans additional databases of military death records sourced from government archives

- Employs supplemental name and address deceased verification, with optional GLB regulated data

- Incorporates over 500 confidence levels incorporating state approved matching logic

- Features customizable logic tailors output to state and holder requirements

- Optimized to identify specific groups of confirmed or potentially deceased annuitants

- Exceeds all defined state standards and reduces known gaps in SSA's DMF reliability

Improving address quality, increases owner/beneficiary location, improves asset reunification, facilitates the cross-sell of other insurance or investment products to keep assets under management and reduces the cost of compliance.

- USPS CASS-Certified software validates addresses, increasing postal deliverability

- Isolates multiple-owner names within a single account registration for proper handling

- Distinguishes legal ownership designations from true name and address components to help understand legal relationships

- Repairs addresses for state mandated due diligence mailings and to improve outreach

- Integrates United States Department of Treasury OFAC screening

- Optional National Change Of Address (NCOA) processing to identify current addresses

- Retains original books and records data "as-is" for audit trail and reporting purposes

In accordance with Texas vs New Jersey (379 U.S. 674 (1965), holders must report unclaimed property to the owner's last known address. Identifying an accurate jurisdiction ensures property is delivered to the correct state which both improves owner reunification and insures legal compliance. An account with missing or incorrect elements, or a mailing returned as undeliverable, does not mean there is insufficient books and records data to ascertain a proper jurisdiction. Cross Country Computer's APEARS® provides a best-in-class level of interrogation, results and documentation to help demonstrate that you have exceeded reporting requirements, thus reducing your liability.

- Deep analysis of holder books and records to ascertain appropriate reporting jurisdictions

- Determination of missing address elements, such as absence of city or absence of state

- Verification of retired cities and towns by state to validate jurisdiction determinations even if a location is no longer recognized by current-day postal standards

- Identification of typographical errors contained in holder's books and records within state approved confidence levels (i.e. "Maine" erroneously appearing as "MA")

- Interrogation of addresses to weigh likelihood of alternate jurisdiction determinations

- Reduction of records requiring manual review by as much as 90%, allowing holders to cost effectively manage the reporting process within mandated timelines

- Proven track record of decreasing the amount of property erroneously defaulting to a holder's state of incorporation by as much as 40%

- Patented process provides determinations that are accepted by states when accompanied by APEARS® certification

- We hold U.S. Patent No. 7,788,187 on the state-approved APEARS® process

- Lead by a former Unclaimed Property Professionals Organization (UPPO) executive board member

- Subject matter data expertise reviewing insurance company books

- 35+ years of helping companies achieve success

Contact us at TBerger@CrossCountryComputer.com or 631-851-4214 to learn more.

Please Note: Cross Country Computer does not provide services to consumers. We provide solutions to help businesses identify and handle unclaimed property. If you are a policy owner or a potential beneficiary that is searching for lost property, please contact your state unclaimed property department or visit www.missingmoney.com.